Washington, D.C. 20549

FUSION TELECOMMUNICATIONS INTERNATIONAL, INC.

Philip D. Turits, Secretary and Treasurer

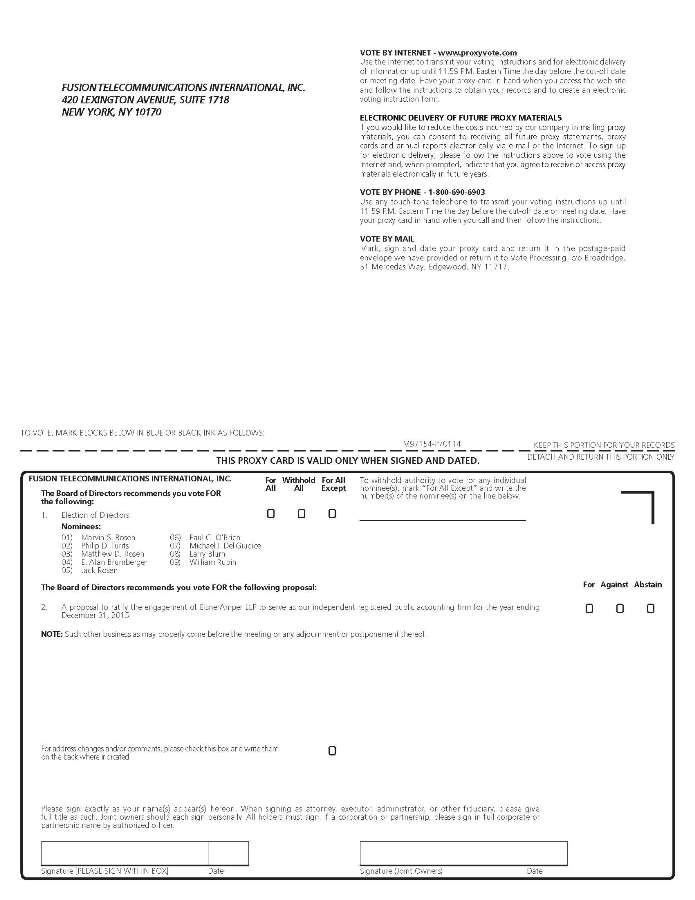

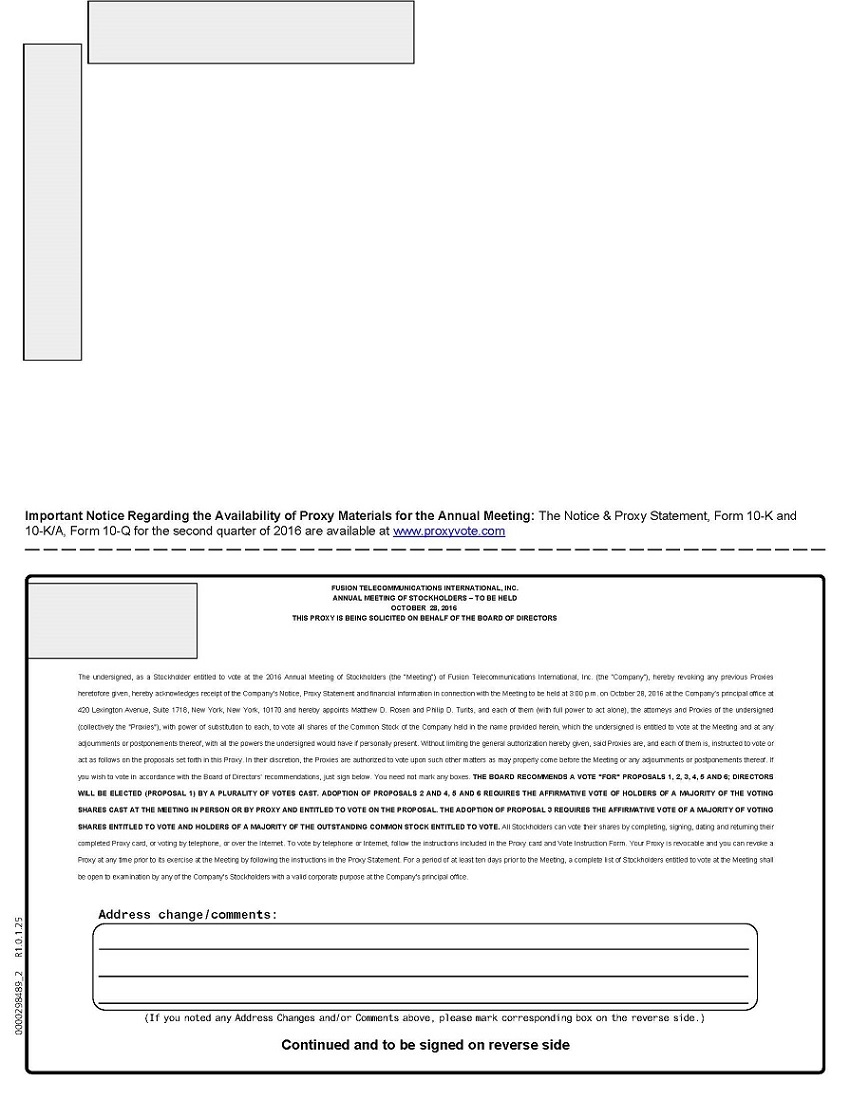

Whether or not you plan to attend the Annual Meeting, we hope that you will vote as soon as possible. You may vote over the Internet, as well as by telephone, or if you requested to receive printed proxy materials, by mailing a proxy or voting instruction form. Please review the instructions on each of your voting options described in thisthe proxy statement, as well as in the Notice of Internet Availability of Proxy Materials you received in the mail.

In the proxy statement, the words “Fusion,” the “Company,” “we,” “our,” “us,” and similar terms refer to Fusion Telecommunications International, Inc. and its consolidated subsidiaries, unless the context indicates otherwise.

Following are some commonly asked questions raised by our stockholders and answers to each of those questions.

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

The Notice, proxy card or voting instruction form will contain instructions on how to:

Choosing to receive your future materials by email will save us the cost of printing and mailing documents to you, and will reduce the impact of printing and mailing these materials on the environment. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you revoke it.

Why is the number of shares shown as owned by me online different from the number of shares in my records?

What is the difference between holding shares as a Stockholder of Record compared to owning shares as a Beneficial Owner in "street name?"

You may vote your shares held in your name as a stockholder of record in person at the Annual Meeting. You may vote your shares held beneficially in street name in person at the Annual Meeting only if you obtain a legal proxy from the Organization that holds your shares giving you the right to vote thethose shares. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions as described below so that your vote will be counted if you later decide not to attend the meeting.

Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the Annual Meeting. If you are a stockholder of record, you may vote by proxy. You can vote by proxy over the Internet by following the instructions provided in the Notice, or, if you requested to receive printed proxy materials, you can also vote by mail or telephone pursuant to instructions provided in the proxy card. If you hold shares beneficially in street name, you may also vote by proxy over the Internet by following the instructions provided in the Notice, or, if you requested to receive printed proxy materials, you can also vote by telephone or mail by following the voting instruction form provided to you by the Organization through which you hold your shares.

If you are a stockholder of record, you may revoke your vote at any time prior to taking the vote at the Annual Meeting by:

● attending the Annual Meeting and voting in person.

If you hold shares beneficially in street name, you may change your vote at any time prior to the taking of the vote at the Annual Meeting by:

Stockholders who hold shares in street name may contact the Organization through which they hold their shares to request information about householding.

How many shares must be present or represented to conduct business at the Annual Meeting?

The quorum requirement for holding the Annual Meeting and transacting business is that holders of a majority of the voting power of Fusion’s Voting Sharesshares entitled to vote as of the Record Date must be present in person or represented by proxy. Both abstentions and broker non-votes (described below) are counted for the purpose of determining the presence of a quorum.

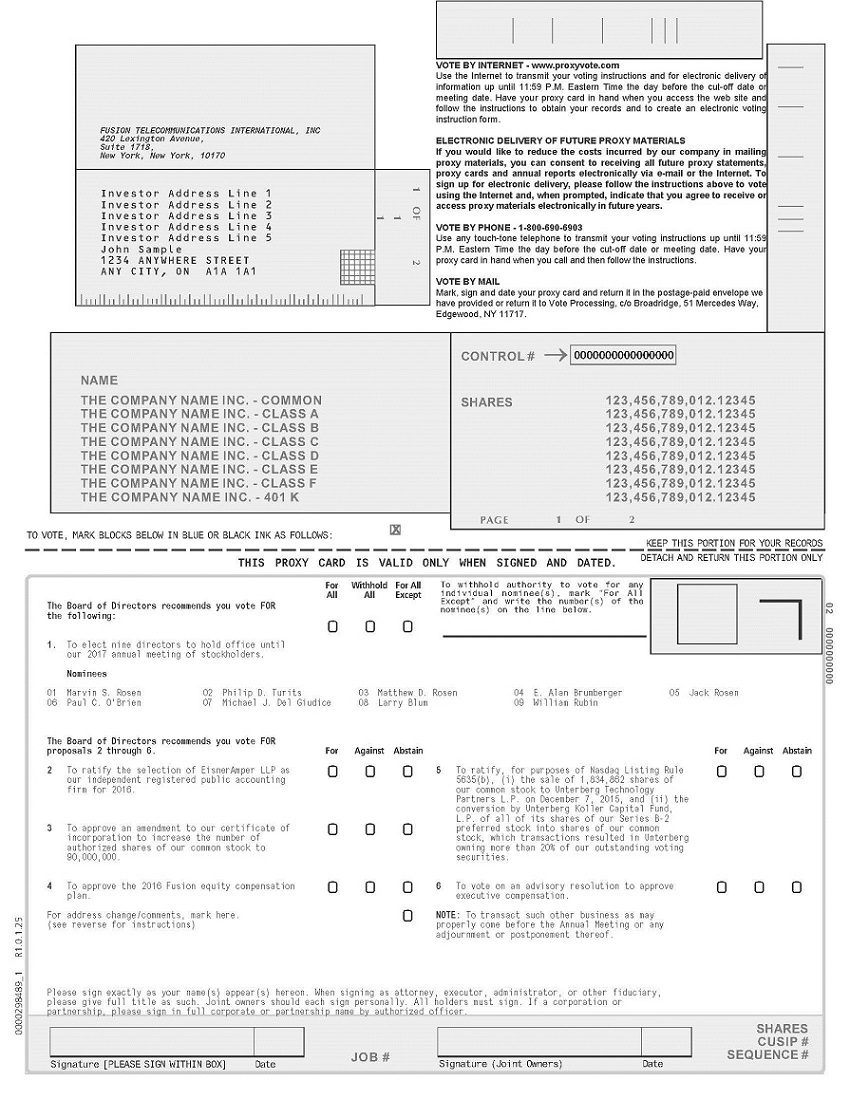

In the election of directors (Proposal Number 1), you may vote “FOR” all or some of the nominees or your vote may be “WITHHELD” with respect to one or more of the nominees.

Please note that since brokers may not vote your shares on “non-routine” matters, in the absence of your specific instructions, we encourage you to provide instructions to your broker regarding the voting ofhow you wish them to vote your shares.

Fusion will pay the costs of preparing, assembling, printing, mailing, and distributing these proxy materials and soliciting votes. If you choose to access these proxy materials and/or vote over the Internet, you are responsible for any Internet access charges you may incur. If you choose to vote by phone, you are responsible for any telephone

charges you may incur. We have not retained a proxy solicitor in conjunction with the Annual Meeting, but we reserve the right to do so if it is determined necessary. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone, or by electronic communications by our directors, officers and certain of our other employees, who will not receive any additional compensation for such solicitation activities.

We will announce preliminary voting results at the Annual Meeting and we will publish final voting results in a Current Report on Form 8-K filed with the SEC within four business days after the Annual Meeting.

You are entitled to attend the Annual Meeting if you were a stockholder as of the Record Date or you hold a valid proxy for the Annual Meeting. Since seating is limited, admission to the Annual Meeting will be on a first-come, first-servedfirst-serve basis. You must present a valid photo identification, such as a driver’s license or passport, for admittance. If you are not a stockholder of record but hold shares as a beneficial owner in street name, you must provide proof of beneficial ownership as of the Record Date, such as your most recent account statement prior to October 26, 2015,August 31, 2016, a copy of the voting instruction form provided by your Organization, or other similar evidence of ownership.

If you do not provide a photo identification or comply with the other procedures outlined above, you will not be admitted to the Annual Meeting. For security reasons, you and your bags are subject to search prior to your admittance to the Annual Meeting.

The Annual Meeting will begin promptly at 3:00 p.m., local time.

What is the deadline for submitting proposals for next year’s annual meeting or to nominate individuals to serve as directors?

Fusion Telecommunications International, Inc.

If you have a question about this proxy statement, you may address that question to our Corporate Secretary at the above address, or may call him at 212–201–2407.

Fusion Telecommunications International, Inc.

The Compensation Committee currently does not have a formal procedure with regard to the consideration of candidates recommended by our stockholders. The boardBoard believes that such a procedure may make sense and continues to investigate various procedural options.

The Compensation Committee used the following procedures and guidelines contained in its charter to evaluate and recommend the nominees for director included in this proxy statement:

Based on the review and discussion summarized above, the Audit Committee recommended that the boardBoard include the audited consolidated financial statements in its 20142015 Annual Report on Form 10-K for filing with the SEC.

The members of our Strategic Committee are Marvin S. Rosen – Chairman, E. Alan Brumberger, Michael Del Giudice and Philip D. Turits. Our Strategic Committee evaluates and recommends investment strategies with investment banks and brokerage houses and assists in the evaluation of potential mergers and acquisitions. ThereThe Strategic Committee does not currently is nohave a written charter for the Strategic Committee.charter. The Strategic Committee acts at the direction of the board.Board. The Strategic Committee did not meet in 2014.2015.

Our executive officers direct the day-to-day implementation and monitoring of the management policies and practices established by the boardBoard and its Committees. As part of its periodic meetings with executive management, the boardBoard reviews the Company’s risk management policies and practices.

The following table provides information relating to compensation paid to the directors for the 20142015 fiscal year.

Set forth below is a brief description of the present and past business experience of each of our executive officers.

Mr. Hutchins has served as our President and Chief Operating Officer since March 2008 and as Acting Chief Financial Officer since January 15, 2010.2008. Mr. Hutchins served as our Executive Vice President from December 2005 to March 2008.2008 and as Acting Chief Financial Officer from January 2010 until April 2016. Prior to joining the Company, Mr. Hutchins served as President and Chief Executive Officer of SwissFone, Inc., a telecommunications carrier. Prior to joining SwissFone, Mr. Hutchins served as President and Chief Executive Officer of STAR Telecommunications, Inc., an international telecommunications carrier. Mr. Hutchins has also served as President and Chief Executive Officer of GH Associates, Inc., a management-consulting firm that he founded. During his early career, Mr. Hutchins served as President and Chief Executive Officer of LDX NET, Inc., a fiber optic network company, and held positions with MCI, McDonnell Douglas Corporation and AT&T.

Mr. Kaufman has served as our Chief Strategy Officer since January 2015. Prior to assuming that position, Mr. Kaufman served as President, Business Services, from October 2012 (the date we acquired his company, Network Billing Systems, LLC, a company he founded in 1998) until January 2015. From its founding until its sale in 2012, Mr. Kaufman served as Chief Executive Officer of Network Billing Systems. Prior to founding Network Billing Systems, Mr. Kaufman served as Chief Executive Officer of Target Telecom Inc., a telecommunications service company that he founded in 1984 and sold to WorldCom in 1996.

Ms. Sarro has served as our Executive Vice President of Marketing and Business Development since November 2012. Prior to assuming that role, Ms. Sarro served as our Executive Vice President – Corporate Services from March 2008 to October 2012, as our Executive Vice President, Carrier Services from April 2005 to March 2008, and as our Vice President of Sales and Marketing from March 2002 to April 2005. Prior to joining the Company, Ms. Sarro served as President of the Americas for Viatel, Inc., a global, facilities-based communications carrier. Ms. Sarro has over 20 years of experience in the telecommunications business.industry. Ms. Sarro has also held senior executive marketing and sales management positions at Argo Communications, FTC Communications, TRT Communications and WorldCom.

Ms. Taranto has served as our Principal Accounting Officer since August 6, 2015 and as our Vice President, Finance since January 2014. From January 2014 until August 6, 2015, she also held the position of Vice President, Accounting. Prior to joining us, Ms. Taranto served as Vice President, Finance and Accounting for Broadvox, LLC and from January 2006 to January 2011 served as Vice President, Accounting and Financial Operations for Cypress Communications. From May 2003 to April 2005, Ms. Taranto held senior financial management roles at AirGate PCS (a Sprint Company), where she built thethat company's settlements operations organization and held a position on that company'sits external controls and disclosures committee. Ms. Taranto has over 25 years of financial management experience in the communications industry. Earlier in her career, Ms. Taranto held executive management roles at MCI/Verizon Business, where she led the Global Financial Operations and IT Revenue Systems organizations. Ms. Taranto holds a B.A from William Patterson University.

The following table provides information concerning unexercised options and stock awards that have not vested for each Named Executive Officer as of December 31, 2014.2015. The table gives effect to the Company's 1:50 reverse split completed by us onin May 13, 2014.

(13) Represents shares of common stock issuable upon exercise of options.

Based solely upon the Company’s review of Forms 3 and 4 and amendments thereto furnished to us during or with respect to our most recent fiscal year, and Forms 5 and amendments thereto furnished to us with respect to our most recent fiscal year and any written representation from a reporting person (as defined in Item 405 of Regulation S-K) that no Form 5 is required, during the Company’s most recent fiscal year no reporting person failed to timely file reports required by Section 16(a) of the Exchange Act during the most recent fiscal year or prior fiscal years, except

The following table sets forth securities authorized for issuance under our equity compensation plans as of December 31, 2014.2015.

Michael J. Del Giudice

MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING

PROPOSAL 1

ELECTION OF DIRECTORS

Nominees for Election as Directors

At the Annual Meeting, stockholders will be asked to elect nine nominees to the board.Board. These nominees were recommended by the Compensation Committee and nominated by the board.Board. All of the director nominees are incumbent directors. Each nominee has agreed to serve as a director if reelected.

Our By-laws provide that a director's term extends from the date of his or her election or appointment to the boardBoard until we hold our next annual meeting of stockholders or their successors are duly elected and qualified.

Directors are elected by a plurality of votes cast by stockholders present at the meeting, in person or represented by proxy. Therefore, the nine nominees who receive the greatest number of votes will be elected. Instructions to withhold authority and “broker non-votes” will not be taken into account in determining the outcome of the election of directors.this matter.

Director Background and Qualifications

We believe that those individuals who are nominated to serve as directors should possess the necessary intelligence, business skills, and life experience to make a significant contribution to the Company; should have adequate time to devote to their activities as boardBoard members; should demonstrate the highest level of ethical behavior; should have no conflicts of interest that might influence the performance of their duties as boardBoard members; should have the ability to work effectively and harmoniously with other boardBoard members and with management; and be fully committed to building long-term value for our stockholders.

We seek a boardBoard that is comprised of professionals with diverse backgrounds and who possess business skills directly relevant to the day-to-day activities of the Company. In the information provided below, we identify for each nominee the unique background, business experience, and skills that we believe will allow him to provide effective guidance to management and have a positive impact on the performance of the Company. In particular, we identify the industry, operational, financial, legal and leadership experience that led us to conclude that each of these nominees should be reelected to serve on our board.the Board.

In addition to specific qualifications, the information set forth below includes each nominee’s age, principal occupation, business experience during at least the last five years, and other directorships currently held in public companies.

Marvin S. Rosen, Age 75, Chairman of the Board

Marvin Rosen co-founded the Company in 1997. He has served as the Chairman of the Board since November 2004, Vice Chairman of the Board from December 1998 to November 2004 and has been a member of the boardBoard since March 1998. He served as our Chief Executive Officer from April 2000 to March 2006. In January 2014, he rejoined the international law firm of Greenberg Traurig as a shareholderstockholder specializing in corporate securities matters. He previously was a shareholderstockholder of that firm and also acted as Of Counsel for a number of years. Mr. Rosen was Finance Chairman for the Democratic National Committee from September 1995 to January 1997. Currently, he serves on the boardBoard of directorsDirectors of the Robert F. Kennedy Center for Justice and Human Rights and the Howard Gilman Foundation. Mr. Rosen served on the boardBoard of directorsDirectors of Terremark Worldwide, Inc. from 2000 until its sale to Verizon in 2011. Mr. Rosen is also a Principal with Emerald Point Capital Partners, L.L.C., a firm that raises capital primarily for hedge funds and private equity funds. Mr. Rosen’s son, Matthew Rosen, is our Chief Executive Officer, and serves on the board.

our Board of Directors.

Director Qualification: Mr. Rosen’s background as the co-founder and former CEOChief Executive Officer of the Company, a Principal with a financial services firm, a securities attorney and a director of a public company provides him with the industry, financial, legal, and leadership experience necessary to advise the boardBoard on strategic and tactical matters.

Philip D. Turits, Age 82,83, Secretary, Treasurer and Director

Mr. Turits co-founded the Company in 1997 and has served as a directorDirector since September 1997, our Secretary since October 1997, our Treasurer since March 1998 and served as Vice Chairman of the Board from March 1998 to December 1998. From September 1991 to February 1996, Mr. Turits served as Treasurer and Chief Operating Officer for Larry Stuart, Ltd., a consumer products company, and prior to 1991 he served as President and Chief Executive Officer of Continental Chemical Company.

Director Qualification: Mr. Turits’ background as the co-founder and Secretary/Treasurer of the Company and as an experienced corporate executive provides him with the operational, financial, and leadership experience necessary to provide valuable guidance to management, particularly in the financial aspects of our business.business.

Matthew D. Rosen, Age 43,44, Chief Executive Officer and Director

Mr. Rosen has served as a director since May 2005 and has been our Chief Executive Officer since March 2006. He served as our President from March 2006 until March 2008, as our Chief Operating Officer from August 2003 to March 2006, as our Executive Vice President and Chief Operating Officer from February 2002 to August 2003, as our Executive Vice President and President of Global Operations from November 2000 to January 2002 and as our President of US Operations from March 2000 to November 2000. Mr. Rosen is the son of the Company’s Chairman, Marvin Rosen.

Director Qualification: Mr. Rosen’s background as our Chief Executive Officer and as our former Chief Operating Officer, a senior executive in the telecommunications industry, an experienced operations executive and an investment banker provides him with the industry, operational, financial and leadership experience necessary to advise the boardBoard on all aspects of the Company’s business.

E. Alan Brumberger, Age 75,76, Director

Mr. Brumberger has served as a directorDirector since March 1998. Currently, Mr. Brumberger is the Chief Executive Officer of Emerald Point Capital Partners, L.L.C. He is also a Director of Verselus, LLC, a privately owned robotics company.company, and a Director of Youth US-CAEF, a charitable foundation. From 1997 to 2004, he was a partner in Andersen & Co. and its predecessor firms. From 1995 to1997, he was a Managing Director of the Taylor Companies and from 1994 to 1995 was a Managing Director of Brenner Securities, Inc. From 1983 to 1990, Mr. Brumberger was a Managing Director of Drexel Burnham Lambert and a member of the Underwriting and Commitment Committees of that firm. Prior to that, he was a Managing Director of Shearson American Express and a partner at Loeb, Rhoades & Co., a predecessor of Shearson American Express. Mr. Brumberger served for three years as President and Chief Executive Officer of Shearson American Express International Limited, the firm’s international investment banking business in London.

Director Qualifications:Qualification: Mr. Brumberger’ sBrumberger’s background as the current Chief Executive Officer of a financial services firm, an experienced leader in the finance and securities industry and an investment banker provides him with the financial and leadership experience necessary to provide guidanceinput to the boardBoard on various matters, particularly those of a financial nature.

Jack Rosen, Age 69, Director

JackMr. Rosen has served as a directorDirector since July 2012. Mr. Rosen is the founder and Chief Executive Officer of Rosen Partners LLC, a residential and commercial real estate development firm. He is also the current Chairman of the American Council for World Jewry, Inc. and the current President of the American Jewish Congress. In addition, Mr. Rosen oversees a wide array of healthcare, cosmetic and telecommunications business ventures throughout the U.S., Europe and Asia. Mr. Rosen currently serves on the Advisory Board of Altimo, an investment company in Russia, Turkey and the CIS and TurkeyCommonwealth of Independent States operating in the field of mobile and fixed-line communications, and on the board of directors of NextWave Wireless Inc.communications. Mr. Rosen is currently a member of the Council on Foreign Relations, an independent, nonpartisan membership organization, think tank, and publisher.

Director Qualifications:Qualification: Mr. Rosen’s background as a leader in many international organizations and as a corporate director in the telecommunications industry provides him with the leadership experience necessary to provide valuable direction and guidance to executive management and the board.Board.

Paul C. O’Brien, Age 76,77, Director

Mr. O’Brien has served as a directorDirector since August 1998. Since January 1995, he has served as the President of the O’Brien Group, Inc., a consulting and investment firm. From February 1988 to December 1994, he was the President and Chairman of New England Telephone (a subsidiary of NYNEX), now Verizon, a telecommunications company. Mr. O'Brien also serves on the boardBoard of directorsDirectors of SonexisAstrobotics and Extream TV. The Computer Merchant.

Director Qualifications:Qualification: Mr. O’Brien’s background as President of a consulting and investment firm, Chairman of a major telecommunications company and as a corporate director provides him with the industry, operational, financial, and leadership experience necessary to effectively guide the boardBoard on all aspects of the Company’s business.

Michael J. Del Giudice, Age 72,73, Director

Mr. Del Giudice has served as a directorDirector since November 2004. He is a Senior Managing Director of Millennium CreditCapital Markets LLC and Senior Managing Director of MCM Securities LLC, both of which he co-foundedfounded in 1996. Mr. Del Giudice also serves as Chairman of Rockland Capital Energy InvestmentsCarnegie Hudson Resources, LLC, founded in April 2003.2012. Mr. Del Giudice has been a Member of the boardBoard of directorsDirectors of Consolidated Edison Company of New York, Inc. since 1999, and is currently a member of its Audit Committee and Chairman of its Corporate Governance and Nominating Committee. Mr. Del Giudice has served as a director of Reis, Inc. sincefrom 2007 to 2013 and was a director of Barnes and Noble, Inc. from 1999 to September 2010. He is also Vice Chairman of the New York Racing Association and serves as Chairman of the Governor’s Committee on Scholastic Achievement.Association. Mr. Del Giudice was a General Partner and Managing Director at Lazard Freres & Co. LLC from 1985 to 1995. From 1983 to 1985, Mr. Del Giudice was Chief of Staff to New York Governor Mario M. Cuomo. He served from 1979 to 1981 as Deputy Chief of Staff to Governor Hugh L. Carey and from 1975 to 1979 as Chief of Staff to the then Speaker of the New York Assembly.

Director Qualifications:Qualification: Mr. Del Giudice’ sGiudice’s background as a Senior Managing Director of securities and investment firms, an investment banker, Chief of Staff to a Governor and an active corporate director provides Mr. Del Giudicehim with the financial and leadership experience necessary to be a valuable advisor to executive management and the board.

Larry Blum, Age 72,73, Director

Mr. Blum has served as a directorDirector since February 2012. He has been a Senior Advisor for Marcum LLP (formerly known as Marcum Rachlin), independent registered public accountants, since 2011. For more than 18 years, Mr. Blum served as the Managing Partner of Rachlin LLP, directing the firm’s growth to its position as Florida’s largest independent accounting and business advisory firm up until its merger with Marcum LLP in 2009. Mr. Blum has also served as a litigation advisor and is a member of the Florida Bar.

Director Qualifications:Qualification: Mr. Blum’s background as a managing partner of a public accounting firm and his expertise in the areas of strategic planning, mergers and acquisitions and domestic and international taxation provides him with the financial and leadership experience to be a valuable advisor to executive management and the board.Board.

William Rubin, Age 62,63, Director

Mr. Rubin has served as a director since February 2012. Since 1992, he has been President of the Rubin Group, a consulting firm representing clients before governmental entities. Previously, he was Assistant Insurance Commissioner and Treasurer of the State of Florida, where he was directly responsible for all activities related to the Florida State Board of Administration, the agency that manages the investments for Florida’s pension funds. Mr. Rubin also serves as an advisor to many large companies, primarily health care companies doing business in Florida.

Director Qualifications: Mr. Rubin’s background as a senior governmental official and a lobbyist provides him with the financial and leadership experience necessary to be a valuable advisor to executive management and the board.Board.

Board Recommendation and Vote Required for Approval

THE BOARD OF DIRECTORS BELIEVES THAT A VOTE "FOR" EACH OF THE NINE DIRECTOR NOMINEES IS IN THE BEST INTEREST OF OUR STOCKHOLDERS AND THE COMPANY. THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH DIRECTOR NOMINEE. DIRECTORS ARE ELECTED BY A PLURALITY OF THE VOTES CAST AT THE ANNUAL MEETING IN PERSON OR REPRESENTED BY PROXY. ONLY VOTES CAST "FOR" OR "WITHHELD" WILL BE COUNTED. ABSTENTIONS AND “BROKER NON-VOTES” WILL HAVE NO EFFECT ON THE OUTCOME OF PROPOSAL 1.

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANT

Subject to ratification by our stockholders, our Audit Committee, in accordance with its charter (see "Board Committees; Audit Committee”,Committee,” included elsewhere in this Proxy Statement) has engagedproxy statement) intends to engage EisnerAmper LLP as the Company's independent registered public accountants to audit our consolidated financial statements for the fiscal year ending December 31, 201.2016. Representatives of EisnerAmper LLP are expected to attend the Annual Meeting, will have an opportunity to make a statement if they so desire and are expected to be available to respond to appropriate questions.

Audit and Audit Related Fees

The fees billed for professional services rendered by EisnerAmper LLP for the year ended December 31, 2014 was approximately $167,000. The fees billed for professional services by Rothstein Kass for the years ended December 31, 20142015 and 20132014 were approximately $30,000$147,000 and $233,000,$167,000, respectively. TheseThe fees billed for professional services included fees associated with the audit of the Company’s annual financial statements, reviews of the Company’s quarterly financial statements and consentconsents for the Company’s registration statement.statements.

Tax Related Fees

There were no fees billed for tax-related services by EisnerAmper LLP during the year ended December 31, 2014. The fees billed for tax-related services rendered by RK during the years ended December 31, 20142015 and 2013 were $0 and approximately $28,000, respectively.2014.

All Other Fees

There were no other fees for other services billed by EisnerAmper LLP that were not included in the categories above during the year ended December 31, 2014. Fees for other services that were not included in the categories above billed by RKEisnerAmper LLP during the years ended December 31, 2015 and 2014 were approximately $120,000 and 2013 were $0, and approximately $22,000, respectively. These fees were primarily for audit and due diligence services related to business acquisition transactions undertaken by the Company.

Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Accountants

Consistent with SEC policies regarding auditor independence, the Audit Committee has the responsibility for appointing, setting compensation and overseeing the work of the independent accountants. In recognition of this responsibility, the Audit Committee has established a policy to pre-approve all audit and permissible non-audit services provided by the independent accountant.

Prior to engagement of the independent accounting firm for the audit of the Company’s 20152016 consolidated financial statements, management will submit to the Audit Committee for approval an aggregate of services expected to be rendered during that year for each of the three categories of services.

Audit and audit-related services include audit work performed in the preparation of annual financial statements, reviews of the Company’s interim financial statements and work that generally only the independent accountants can reasonably be expected to provide, including comfort letters, statutory audits, employee benefit plan audits and attesttest services and consultation regarding financial accounting and/or reporting standards.

Other feesFees are those fees associated with services not captured in the other categories, including due diligence and other audit services related to mergers and acquisitions.

Prior to engagement, the Audit Committee pre-approves these services by category of service. During the year, circumstances may arise when it may become necessary to engage the independent accounting firm for additional services not contemplated in the original pre-approval. In those instances, the Audit Committee requires specific pre-approval before engaging the independent accountant.

The Audit Committee may delegate pre-approval authority to one or more of its members. The member to whom such authority is delegated must report, for informational purposes only, any pre-approval decisions to the Audit Committee at its next scheduled meeting.

Board Recommendation and Vote Required for Approval

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" PROPOSAL 2. THE APPROVAL OF PROPOSAL 2 REQUIRES THE AFFIRMATIVE VOTE BY HOLDERS OF A MAJORITY OF OURVOTING SHARES PRESENTCAST AT THE ANNUAL MEETING, IN PERSON OR BY PROXY, AND ENTITLED TO VOTE ON THE PROPOSAL. ABSTENTIONS AND “BROKER NON-VOTES” WILL HAVE NO EFFECT ON THE OUTCOME OF PROPOSAL 2.

PROPOSAL 3

AMENDMENT TO THE COMPANY’S CERTIFICATE OF INCORPORATION

TO INCREASE THE NUMBER OF AUTHORIZED COMMON SHARES

Introduction and Summary of the Proposed Amendment

The Company’s Amended and Restated Certificate of Incorporation (the “Certificate”) currently authorizes the issuance of up to 50 million shares of common stock, par value $0.01 per share, and 10 million shares of preferred stock, $0.01 par value per share. On August 22, 2016, the Board unanimously adopted a resolution approving, subject to the approval of the Company’s stockholders, an amendment to the fourth Article of the Certificate to increase the total number of shares of common stock that the Company is authorized to issue from 50 million to 90 million shares. As of August 31, 2016, 14,993,732 shares of common stock were issued and outstanding. In addition, approximately 1,260,000 shares are reserved for future issuance under the Company’s employee stock plans, of which approximately 1,158,251 shares are covered by outstanding stock options. As a result, the number of shares of common stock available for issuance, after taking into account shares reserved for issuance under the Company’s employee stock plans, retention stock awards, outstanding warrants and conversion of outstanding Series B-2 preferred stock is 18,425,132.

The Board believes that it is advisable and in the best interests of the Company and its stockholders to increase the total number of authorized shares of common stock in order to provide the Company with greater flexibility in considering and planning for potential future corporate needs.

Text of the Proposed Amendment

The Company proposes to amend the existing language of the fourth Article of the Certificate as follows:

“FOURTH: The total number of shares of Capital Stock which the Corporation shall have authority to issue is 100,000,000, of which 90,000,000 shares shall be Common Stock, par value $0.01 per share, and 10,000,000 shares shall be Preferred Stock, par value $0.01 per share.”

The proposed amendment of the Certificate will not affect the number of shares of preferred stock authorized.

A copy of the Certificate, as amended by the proposed change to the fourth Article, is attached to this proxy statement as Annex A in the form of a blacklined, or comparison, copy of the existing Certificate with the proposed amendment to the fourth Article identified.

Rationale for the Amendment and Factors to Consider

The Board believes that the additional authorized shares of common stock will provide the Company with the necessary flexibility to utilize shares for various corporate purposes that may be identified in the future. These corporate purposes may include, but are not limited to, potential strategic transactions (such as mergers, acquisitions and other business combinations), future stock splits and stock dividends, capital-raising or financing transactions, grants and awards under the equity incentive plans, and other types of general corporate purpose transactions. We believe that it is important for the Company to have the flexibility to issue shares beyond the amounts remaining in the 50 million of currently authorized shares of common stock without the delay or expense associated with convening a special stockholders’ meeting to secure stockholder approval at that time. The Company currently does not have any plans, commitments, arrangements, understandings or agreements to issue any of the additional shares of common stock that would be authorized pursuant to the proposed amendment of the Certificate or any of the currently authorized and unissued shares of its common stock (except for shares of common stock reserved for issuance upon conversion of shares of Series B-2 preferred stock, upon exercise of warrants and pursuant to previously granted awards under its existing equity plans or for future issuances under the 2009 Plan and the 2016 equity incentive plan submitted for approval at this Annual Meeting).

The additional authorized shares of common stock, if and when issued, would be part of the existing class of common stock and would have the same rights and privileges as the shares of common stock currently outstanding. The authorization of the additional shares of common stock sought by this proposal would not have any immediate dilutive effect on the proportionate voting power or other rights of existing stockholders but, to the extent that the additional authorized shares of common stock are issued in the future or are used in connection with securities convertible into shares of common stock, they may decrease existing stockholders’ percentage of equity ownership and thus could be dilutive to existing stockholders. Depending on the price at which such shares are issued, they also may have a negative effect on the market price of our common stock. Any such future issuances also could have a dilutive effect on the Company’s earnings per share and book value per share.

In addition, although the Board has not proposed the increase in the total number of authorized shares of common stock with the intent of using the additional shares to prevent or discourage any actual or threatened takeover of the Company, under certain circumstances, such shares could have an anti-takeover effect. For example, the additional shares could be issued to dilute the stock ownership or voting rights of persons seeking to obtain control of the Company or could be issued to persons allied with the Board or management, thereby having the effect of making it more difficult to remove directors and management by diluting the stock ownership or voting rights of persons seeking to effect such a removal or to otherwise effect a takeover of the Company. As such, if the proposed amendment is approved, the additional shares of authorized common stock may render more difficult or discourage a non-consensual merger, a tender offer or proxy contest, the assumption of control by a holder of a large block of our common stock, or the replacement or removal of the Board (and thus management).

Applicable law requires that the Company disclose in connection with this proposal the provisions in its Certificate and By-laws that could have an anti-takeover effect. The following provisions of our Certificate or By-laws may have the anti-takeover effect of preventing, discouraging or delaying a change in the control of the Company: our By-laws provide that special meetings may be called by the Board or the Chief Executive Officer, or upon written request delivered to the Chief Executive Officer by stockholders holding at least a majority of all the shares entitled to vote at the meeting. No business other than that stated in the notice may be transacted at any special meeting; provided, however, that matters given by or at the direction of the Board may be presented. In addition, the Company’s Chairman, in his or her sole discretion, may present, or accept for presentation, procedural matters. These provisions may have the effect of delaying consideration of a stockholder proposal until the next annual meeting unless a special meeting is called by the Board or the Company’s stockholders, as noted above; and our Certificate provides for 10 million authorized shares of preferred stock, which may enable the Company to render more difficult or to discourage an attempt to obtain control of it by means of a non-consensual merger, a tender offer, proxy contest, or otherwise. The Certificate grants the Board broad powers to establish the rights and preferences of authorized and unissued shares of preferred stock, which could be used to adversely affect the rights and powers, including voting rights, of stockholders and could also have the effect of delaying, deterring or preventing a change in control of the Company.

It is not the intended purpose of the proposed amendment to the Certificate, and the Board has no current intention or plan to employ the proposed increase in the Company’s authorized shares of common stock, to discourage or prevent any persons from attempting to takeover take the Company. Rather, the proposed amendment has been prompted by business and financial considerations, as set out above, and it is the intended purpose of the proposed amendment to the Certificate to provide greater flexibility to the Board in considering and planning for potential future corporate needs.

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" PROPOSAL 3. THE APPROVAL OF PROPOSAL 3 REQUIRES THE AFFIRMATIVE VOTE BY (A) HOLDERS OF A MAJORITY OF OUR OUTSTANDING VOTING SHARES ENTITLED TO VOTE ON PROPOSAL 3, AND (B) HOLDERS OF A MAJORITY OF OUR OUTSTANDING SHARES OF COMMON STOCK, VOTING AS A SEPARATE GROUP. ABSTENTIONS AND “BROKER NON-VOTES” WILL HAVE THE EFFECT OF A VOTE “AGAINST” PROPOSAL 2.3.

PROPOSAL 4

APPROVAL OF THE

2016 FUSION EQUITY INCENTIVE PLAN

General Information

On March 26, 2009, the Board adopted the 2009 Plan, which reserved 140,000 shares for issuance thereunder, and which was then amended with stockholder approval on February 15, 2013 to increase the number of shares reserved for issuance to 330,000, and then again on March 28, 2014 to further increase the number of shares reserved for issuance to 1,260,000. Since 2009, the Company has been granting stock options pursuant to the 2009 Plan.

On August 22, 2016, the Board adopted, subject to stockholder approval, the Fusion Telecommunications International, Inc. 2016 Equity Incentive Plan (the “2016 Plan”). The 2016 Plan expands the types of award available under the 2009 Plan and provides for the grant of incentive stock options, non-qualified stock options, stock appreciation rights (“SARs”), restricted stock, restricted stock units, stock grants, stock units, performance shares, performance share units and performance cash. The 2016 Plan also permits the grant of awards that are intended to qualify for the “performance-based compensation” exception to the $1.0 million limitation on the deduction of compensation imposed by Section 162(m) of the Tax Code. If it is approved by stockholders, the 2016 Plan will supersede and replace the 2009 Plan, provided that the 2009 Plan will remain in effect until all awards granted under it have been exercised, forfeited, canceled, expired or otherwise terminated.

As of August 31, 2016, a total of 101,749 shares remained available for grant under the 2009 Plan. In order to continue to have an appropriate supply of shares for equity incentives to recruit, hire and retain the talent required to successfully execute our business plans, the Company is asking its stockholders to approve the 2016 Plan which reserves a number of shares of common stock equal to ten percent (10%) of our shares outstanding from time-to-time on a fully-diluted basis, plus shares from any award granted under the 2009 Plan that terminates, expires or lapses for any reason in the future. In addition, the 101,749 shares not granted under the 2009 Plan will be available for issuance under the 2016 Plan. Based on estimated usage, the Company believes the additional shares requested will provide the Compensation Committee with sufficient shares for our equity compensation programs until our 2019 Annual Meeting. While reserving a pool of shares equal to ten percent (10%) of our fully-diluted shares outstanding from time-to-time under the 2016 Plan will increase the potential dilution to our current stockholders, the Board believes that our equity compensation plan is well-managed and the flexibility to issue different types of awards such as restricted stock units may decrease the rate of dilution compared to issuances of stock options. In preparing the 2016 Plan, the Company has taken into consideration current best practices with respect to equity-based compensation plans. In this regard, the 2016 Plan contains the following provisions, which we believe reflect best practices for equity-compensation plans: (i) prohibits the grant of stock options and SARs with discounted exercise prices, (ii) prohibits the repricing of stock options and SARs without stockholder approval, (iii) prohibits the recycling of awards tendered in payment of an option or withheld to satisfy tax obligations; (iv) contains a definition of change in control whereby potential acceleration of awards will only occur in the event of an actual change in control transaction; (v) includes, as a general rule, double-trigger vesting following a change in control; and (vi) imposes a $500,000 limit on the value of awards that may be granted to any one participant who is a non-employee director during any 12-month period.

The following is a summary of the material terms of the 2016 Plan that may be of importance to you. The summary is qualified by reference to the full text of the 2016 Plan, which is attached to this proxy statement as Annex B.

Summary of Plan Features

Purpose

The Board believes that the 2016 Plan will promote the success and enhance the value of the Company by linking the personal interests of participants to those of Company stockholders. The Board also believes that the 2016 Plan will enhance the Company’s ability to attract and retain qualified persons to perform services for the Company, by providing incentives to such persons to put forth maximum efforts for the Company and by rewarding persons who contribute to the achievement of the Company’s economic objectives.

Administration

The 2016 Plan will be administered by the Compensation Committee. The Compensation Committee must be comprised of at least two independent members of the Board. Each Compensation Committee member must be a “non-employee director” as defined in Rule 16b-3 of the Exchange Act, an “outside director” as defined in Section 162(m) of the Tax Code, and an “independent” director for purposes of the applicable Nasdaq Listing Rules. The Compensation Committee, by majority action, is authorized to interpret the 2016 Plan, to prescribe, amend, and rescind rules and regulations relating to the 2016 Plan, to provide for conditions and assurances deemed necessary or advisable to protect the interests of the Company, and to make all other determinations necessary or advisable for the administration of the 2016 Plan, to the extent they are not inconsistent with the 2016 Plan.

Subject to the express provisions of the 2016 Plan, the Compensation Committee will have the authority to determine the participants who are entitled to receive awards under the 2016 Plan, the types of awards, the times when awards shall be granted, the number of awards, the purchase price, exercise price, or base value, if any, the period(s) during which such awards shall be exercisable (whether in whole or in part), the restrictions applicable to awards, and the form of each award agreement. Neither the award agreement nor the other terms and provisions of any award must be identical for each participant. The Compensation Committee also will have the authority to modify existing awards, subject to specified provisions of the 2016 Plan and the listing requirements of Nasdaq. The 2016 Plan prohibits the Compensation Committee from repricing any previously granted option or SAR without first obtaining stockholder approval. In the case of awards made to non-employee directors, the Board, and not the Compensation Committee, shall administer the 2016 Plan.

Stock Subject to 2016 Plan

The total number of shares of common stock reserved under the 2016 Plan will be an amount equal to ten percent (10%) of our shares outstanding from time-to-time on a fully-diluted basis, plus shares from any award granted under the 2009 Plan that terminates, expires or lapses in any way in the future. In addition, the 101,749 shares not granted under the 2009 Plan will be available for grant under the 2016 Plan. Subject to the express provisions of the 2016 Plan, if any award granted under the 2016 Plan terminates, expires, or lapses for any reason, or is paid in cash, any stock subject to or surrendered after the date the 2016 Plan is approved by stockholders, such award will again be stock available for the grant of an award under the 2016 Plan. The exercise of a stock-settled SAR, or broker-assisted “cashless” exercise of an option (or a portion thereof) will reduce the number of shares of stock available for issuance pursuant to the 2016 Plan by the entire number of shares of stock subject to that SAR or option (or applicable portion thereof), even though a smaller number of shares of stock will be issued upon such an exercise. Also, shares of stock tendered to pay the exercise price of an option or tendered or withheld to satisfy a tax withholding obligation arising in connection with an award will not become available for use under the 2016 Plan.

Individual Limitations on Awards

The maximum number of shares of common stock that may be granted to any one participant during any 12-month period with respect to one or more awards is $5,000,000. The maximum performance cash award payable during any 12-month performance period to any one participant is $1,000,000. The aggregate grant date fair market value of awards granted to any one participant who is a non-employee director during any 12-month period with respect to one or more awards is $500,000. The maximum number of shares of common stock subject to incentive stock options under the 2016 Plan is the limit set forth in Section 5.1 of the 2016 Plan.

As of August 26, 2016, the closing price of the Company’s stock on Nasdaq was $1.70 per share.

Eligibility

All employees, officers, non-employee directors of, and consultants to, the Company or an affiliate, as determined by the Compensation Committee, are eligible to participate in the 2016 Plan.

Awards Available Under the 2016 Plan

The following types of awards may be granted pursuant to the 2016 Plan: incentive stock options, nonqualified stock options, SARs, restricted stock, restricted stock units, performance shares, performance share units, performance cash, stock grants and stock units.

Stock Options. The Compensation Committee may grant incentive stock options and non-qualified stock options under the 2016 Plan. Incentive stock options may be granted only to participants who are employees. The exercise price of all options granted under the 2016 Plan must be at least 100% of the fair market value of the Company’s common stock on the date granted and no option may be exercised more than ten (10) years from the date of grant. The Compensation Committee will determine how the exercise price of an option may be paid and the form of payment, including, without limitation, cash, shares of stock held for longer than six months (through actual tender or by attestation), any net-issuance arrangement or other property acceptable to the Compensation Committee (including broker-assisted “cashless exercise” arrangements), and how shares of stock will be delivered or deemed delivered to participants. A participant will have no rights as a stockholder with respect to options until the record date of the stock purchase.

Stock Appreciation Rights. The Compensation Committee also may grant SARs under the 2016 Plan. SARs give the participant the right to receive the appreciation in value of one share of common stock of the Company. Appreciation is calculated as the excess of (i) the fair market value of a share of our common stock on the date of exercise over (ii) the base value fixed by the Compensation Committee on the grant date, which may not be less than the fair market value of a share of common stock on the grant date. Payment for SARs shall be made in cash, stock, or a combination thereof. SARs are exercisable at the time and subject to the restrictions and conditions as the Compensation Committee approves, provided that no SAR may be exercised more than ten (10) years following the grant date.

Restricted Stock. The Compensation Committee may grant restricted stock under the 2016 Plan. A restricted stock award gives the participant the right to receive a specified number of shares of common stock at a purchase price determined by the Compensation Committee (including and typically zero). Restrictions limit the participant’s ability to transfer the stock and subject the stock to a substantial risk of forfeiture until specific conditions or goals are met. The restrictions will lapse in accordance with a schedule or other conditions as determined by the Compensation Committee, which typically involve the achievement of specified performance targets and/or continued employment of the participant until a specified date. As a general rule, if a participant terminates employment when the restricted stock is subject to restrictions, the participant forfeits the unvested restricted stock.

Restricted Stock Units. The Compensation Committee also may grant restricted stock unit awards under the 2016 Plan. A restricted stock unit award gives the participant the right to receive common stock, or a cash payment equal to the fair market value of common stock (determined as of a specified date), in the future, subject to restrictions and a risk of forfeiture. The restrictions typically involve the achievement of specified performance targets and/or the continued employment or service of the participant until a specified date. Participants holding restricted stock units have no rights as a stockholder with respect to the shares of stock subject to their restricted stock unit award prior to the issuance of such shares pursuant to the award.

Stock Grant Awards. The Compensation Committee may grant stock grant awards upon such terms and conditions, and at any time, and from time to time, as the Compensation Committee shall determine. A stock grant award gives the participant the right to receive (or purchase at such price as determined by the Compensation Committee) shares of stock, free of any vesting restrictions. The purchase price, if any, for a stock grant award shall be payable in cash or in any other form of consideration acceptable to the Compensation Committee. A stock grant award may be granted or sold in respect of past services or other valid consideration, or in lieu of any cash compensation owed to a participant.

Stock Unit Awards. The Compensation Committee may grant stock unit awards upon such terms and conditions, and at any time, and from time to time, as the Compensation Committee shall determine. A stock unit award gives the participant the right to receive shares of stock, or a cash payment equal to the fair market value of a designated number of shares, in the future, free of any vesting restrictions. A stock unit award may be granted or sold in respect of past services or other valid consideration, or in lieu of any cash compensation owed to a participant.

Performance Shares. The Compensation Committee also may grant performance share awards under the 2016 Plan. A performance share award gives the participant the right to receive common stock of the Company if the participant achieves the performance goals specified by the Compensation Committee during a performance period specified by the Compensation Committee. Each performance share will have a value determined by the Compensation Committee at the time of grant.

Performance Share Units. The Compensation Committee also may grant performance share unit awards under the 2016 Plan. A performance share unit award gives the participant the right to receive common stock of the Company, a cash payment or a combination of stock and cash, if the participant achieves the performance goals specified by the Compensation Committee during a performance period specified by the Compensation Committee. Each performance share unit will have a value determined by the Compensation Committee at the time of grant.

Performance Cash. The Compensation Committee may grant performance cash awards upon such terms and conditions, and at any time, and from time to time, as the Committee shall determine. A performance cash award gives the participant the right to receive an amount of cash depending on the satisfaction of one or more performance goals for a particular performance period. The achievement of the performance goals for a particular performance period will determine the ultimate value of the performance cash award.

Performance-Based Awards. When the Compensation Committee grants options, restricted stock, restricted stock units, stock grants, stock units, performance shares, performance share units or performance cash, it may designate the award as a performance-based award. Options and SARs granted pursuant to the 2016 Plan should, by their terms, qualify as performance-based awards. Performance-based awards are intended to qualify for the “performance-based compensation” exception to the limitations on the deduction of compensation imposed by Section 162(m) of the Tax Code.

Section 162(m) of the Tax Code only applies to “covered employees” as that term is defined in Section 162(m) of the Tax Code. Therefore, only covered employees are eligible to receive awards that are designated as performance-based awards. The Compensation Committee has complete discretion regarding whether to grant awards to covered employees that qualify for the “performance-based compensation” exception. If the Committee designates a particular award as a performance-based award, the Compensation Committee will attempt to design and administer the award in a manner that will allow the award to qualify for the “performance-based compensation” exception under Section 162(m) of the Tax Code. Nevertheless, the requirements of this exception are complex and in some respects vague and difficult to apply. Consequently, we cannot guarantee that compensation that is intended to qualify for the “performance-based compensation” exception under Section 162(m) of the Tax Code will in fact so qualify. The Compensation Committee may, in its discretion, grant awards under the 2016 Plan to covered employees that do not qualify for the exception.

The payment of options, restricted stock, restricted stock units, stock grants, stock units, performance shares, performance share units or performance cash that are designated as performance-based awards is contingent upon a covered employee’s achievement of pre-established performance goals during a specified performance period. Performance goals are based on any one or more pre-established performance criteria. The pre-established performance criteria are limited to the following: net operating income before taxes and extraordinary charges against income; earnings before interest, and taxes; earnings before interest, taxes, depreciation, and amortization; pre- or after-tax net earnings; sales growth; production levels; unit costs; operating earnings; operating cash flow; return on net assets; return on stockholders’ equity; return on assets; return on capital; stock price growth; stockholder returns; gross or net profit margin; earnings per share; price per share of stock; market share; revenue; income; safety objectives; environmental objectives; and completion of major projects. Any of the performance criteria may be measured either in absolute terms or as compared to any incremental increase or as compared to results of a peer group, indices, or any other basket of companies. Performance goals may be expressed in terms of overall Company performance, the performance of a business unit, division, affiliate, or the performance of an individual. Financial performance criteria may, but need not, be calculated in accordance with generally accepted accounting principles (“GAAP”) or any successor method to GAAP, including International Financial Reporting Standards. The Compensation Committee shall, within the time prescribed by Section 162(m) of the Tax Code, define in an objective fashion the manner of calculating the performance criteria it selects to use for a particular performance period for a particular participant.

With respect to any performance-based award granted to a covered employee that qualifies for the “performance-based compensation” exception to the Section 162(m) limitation, the Compensation Committee has the discretion to: select the length of the performance period, the type of performance-based awards to be issued, the kind and/or level of performance goal or goals and whether the performance goal or goals apply to the Company, an affiliate or any division or business unit of any of them, or to the individual participant or any group of participants. The Compensation Committee has the discretion to decrease, but not increase, the amount of compensation payable pursuant to any performance-based award. The Compensation Committee must certify in writing prior to the payment of any performance-based award that the performance goals and any other material terms and conditions precedent to such payment have been satisfied.

The performance criteria and other related aspects of the 2016 Plan will be subject to stockholder approval again in 2021 if (as is currently the case) stockholder approval is then required to maintain the tax-deductible nature of performance-based compensation under the 2016 Plan.

The maximum performance-based award (other than a performance cash award) payable to any one participant for any 12-month period is 1,000,000 shares of stock (or the equivalent cash value). The maximum performance cash award (or performance share unit payable in cash) payable to any one participant for any 12-month performance period is $1,000,000. If the performance period is less than or exceeds 12 months, the dollar and share limits expressed in this paragraph shall be reduced or increased proportionally.

Restrictions

The Compensation Committee may impose such restrictions on any awards under the 2016 Plan as it may deem advisable, including restrictions under applicable federal securities law, under the requirements of any stock exchange upon which the Company’s common stock is then listed and under any blue sky or state securities law applicable to the awards.

Change in Control

If so specified by the Compensation Committee at the time of the grant of an award, such award may provide that in the event of a participant’s termination of employment without “cause” or “good reason” (as those terms are defined in the 2016 Plan), following a change in control, such award shall become fully vested and exercisable and all restrictions on such award shall lapse as of the date of termination.

Non-transferability

Unless otherwise determined by the Compensation Committee, no award granted under the 2016 Plan may be sold, transferred, pledged, assigned, or otherwise alienated or hypothecated, otherwise than by will or by the laws of descent and distribution or pursuant to a domestic relations order (that would otherwise qualify as a qualified domestic relations order as defined in the Tax Code or Title I of the Employee Retirement Income Security Act of 1974, but for the fact that it relates to an award granted under the 2016 Plan), or, if applicable, until the termination of any restricted or performance period as determined by the Compensation Committee.

Adjustment Provisions

If there is a change in the outstanding shares of common stock because of a stock dividend or split, recapitalization, liquidation, merger, consolidation, combination, exchange of shares, or other similar corporate change, the aggregate number of shares of stock available under the 2016 Plan and subject to each outstanding award, and its stated exercise price or the basis upon which the award is measured, shall be adjusted by the Compensation Committee. Moreover, in the event of such transaction or event, the Compensation Committee, in its discretion may provide in substitution for any or all outstanding awards under the 2016 Plan such alternative consideration (including cash) as it, in good faith, may determine to be equitable under the circumstances and may require in connection therewith the surrender of all awards so replaced. Any adjustment to an incentive stock option shall be made consistent with the requirements of Section 424 of the Tax Code. Further, any adjustments made shall be made consistent with the requirements of Section 409A of the Tax Code.

Claw back

Every award granted under the 2016 Plan is subject to potential forfeiture or recovery to the fullest extent called for by law, any applicable listing standard, or any current or future claw back policy that may be adopted by the Company from time to time, including, without limitation, any claw back policy adopted to comply with final rules issued by the SEC and any final listing standards to be adopted by Nasdaq pursuant to Section 954 of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Amendment, Modification and Termination of 2016 Plan

Subject to the Board’s right to terminate, amend or modify the 2016 Plan at any time, the 2016 Plan will remain in effect until all awards issued under the 2016 Plan expire, terminate, are exercised or are paid in full in accordance with the 2016 Plan provisions and any award agreement. However, no award may be granted under the 2016 Plan after the tenth anniversary of the date the 2016 Plan is approved by the Company’s stockholders.

The Board has discretion to terminate, amend or modify the 2016 Plan. Any such action of the Board is subject to the approval of the stockholders to the extent required by the 2016 Plan, law, regulation or the rules of any exchange on which our common stock is listed. Except as otherwise provided in the 2016 Plan, neither the Board, the Chief Executive Officer, nor the Compensation Committee may do any of the following without stockholder approval: increase the number of shares available under the 2016 Plan; reprice any award; grant options or SARs with an exercise price or base value that is below fair market value of a share of common stock on the grant date; extend the exercise period or term of any option or SAR beyond ten (10) years from the grant date; expand the types of awards available for grant under the 2016 Plan; or expand the class of individuals eligible to participate in the 2016 Plan.

Tax Withholding

The Company shall have the power to withhold, or require a participant to remit to the Company, an amount sufficient to satisfy federal, state, and local withholding tax requirements on any award under the 2016 Plan. To the extent that alternative methods of withholding are available under applicable laws, the Company will have the power to choose among such methods.

Federal Income Tax Information

The following is a brief summary of certain of the federal income tax consequences of certain transactions under the 2016 Plan based on federal income tax laws in effect on August 31, 2016. This summary is not intended to be exhaustive and does not describe state or local tax consequences.

As a general rule, a participant will not recognize taxable income with respect to any award at the time of grant except in the case of a participant who receives a restricted stock grant and makes the timely election permitted by Section 83(b) of the Tax Code.

Upon exercise of a nonqualified stock option, the lapse of restrictions on restricted stock, or upon the payment of SARs, restricted stock units, stock grants, stock units, performance shares, performance share units or performance cash, the participant will recognize ordinary taxable income in an amount equal to the difference between the amount paid for the award, if any, and the fair market value of the stock or amount received on the date of exercise, lapse of restriction or payment. The Company will be entitled to a concurrent income tax deduction equal to the ordinary income recognized by the participant.

A participant who is granted an incentive stock option will not recognize taxable income at the time of exercise. However, the excess of the stock’s fair market value over the option price could be subject to the alternative minimum tax in the year of exercise (assuming the stock received is not subject to a substantial risk of forfeiture or is transferable). If stock acquired upon exercise of an incentive stock option is held for a minimum of two years from the date of grant and one year from the date of exercise, the gain or loss (in an amount equal to the difference between the sales price and the exercise price) upon disposition of the stock will be treated as a long-term capital gain or loss, and the Company will not be entitled to any income tax deduction. If the holding period requirements are not met, the incentive stock option will not meet the requirements of the Tax Code and the tax consequences described for nonqualified stock options will apply.

If certain awards fail to comply with Section 409A of the Tax Code, a participant must include in ordinary income all deferred compensation conferred by the award, pay interest from the date of the deferral and pay an additional 20% tax. The award agreement for any award that is subject to Section 409A may include provisions necessary for compliance as determined by the Compensation Committee. The Company intends (but cannot and does not guarantee) that awards granted under the 2016 Plan will comply with the requirements of Section 409A or an exception thereto and intends to administer and interpret the 2016 Plan in such a manner.

Special Rules Applicable to Officers

In limited circumstances where the sale of stock that is received as the result of a grant of an award could subject an officer to suit under Section 16(b) of the Exchange Act, the tax consequences to the officer may differ from the tax consequences described above. In these circumstances, unless a special election has been made, the principal difference usually will be to postpone valuation and taxation of the stock received so long as the sale of the stock received could subject the officer or director to suit under Section 16(b) of the Exchange Act, but not longer than six months.

Tax Consequences to the Company or Its Affiliates

To the extent that a grantee recognizes ordinary income in the circumstances described above, the Company or the subsidiary for which the employee performs services will be entitled to a corresponding deduction provided that, among other things, the income meets the test of reasonableness, is an ordinary and necessary business expense, is not an “excess parachute payment” within the meaning of Section 280G of the Tax Code and is not subject to the $1.0 million deduction limit for certain executive compensation under Section 162(m) of the Tax Code.

New Plan Benefits Table

Awards to employees, officers, directors and consultants under the 2016 Plan are made at the discretion of the Compensation Committee. Therefore, the future benefits and amounts that will be received or allocated under the 2016 Plan are not determinable at this time. However, the following table provides information with respect to awards granted under the 2009 Plan during the fiscal year ending December 31, 2015 to the Company’s Named Executive Officers (individually), officers, including Named Executive Officers (as a group), all current non-employee directors (individually and as a group), and all employees, including officers who are not Named Executive Officers (as a group).

Name and Position or Group | | Stock options | |

| | | |

| Named Executive Officers: | | | |

| Matthew D. Rosen | | | 100,000 | |

| Gordon Hutchins, Jr. | | | 35,000 | |

| Russell P. Markman | | | 25,000 | |

| | | | |

| Current Executive Officers as a Group (7 persons) | | | 245,000 | |

| | | | |

| All Non-Employee Directors as a Group (7 persons) | | | 21,000 | |

| | | | |

| All Employees (including all current officers that are not executive officers) as a Group (291 persons) | | | 348,730 | |

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" PROPOSAL 4. THE APPROVAL OF PROPOSAL 4 REQUIRES THE AFFIRMATIVE VOTE BY HOLDERS OF A MAJORITY OF THE VOTING SHARES CAST AT THE ANNUAL MEETING, IN PERSON OR BY PROXY, AND ENTITLED TO VOTE ON PROPOSAL 4. ABSTENTIONS AND “BROKER NON-VOTES” WILL HAVE NO EFFECT ON THE OUTCOME OF PROPOSAL 4.

PROPOSAL 5

TO RATIFY THE ACQUISITION OF MORE THAN 20% OF VOTING SHARES BY UNTERBERG

Background

In December 2013 and January 2014, we sold, on a private placement basis, a total of 22,838 shares of our Series B-2 preferred stock. Each share of Series B-2 preferred has a liquidation preference of $1,000, ranks senior to all of our other equity securities, has the right to 200 votes on each matter submitted for consideration by holders of our common stock, and are convertible into shares of common stock at the rate of 200 shares per each share of Series B-2 preferred. Under the terms of the Certificate of Designations of the Preferences, Rights and Limitations of the Series B-2 preferred stock, no holder of Series B-2 preferred stock is permitted to vote more than 4.99% of the common shares outstanding or voting power unless they provide the Company with sixty (60) days’ written notice of their intent to do so. In connection with the sale of the Series B-2 preferred stock, we also issued a total of 1,461,632 warrants to purchase common shares, at a price of $6.25 per common share. These warrants were immediately exercisable by the holder thereof.

Of the shares of Series B-2 preferred stock sold, Unterberg Koller, together with its then affiliate Diker MicroCap Fund L.P. ("Diker"), purchased 6,000 shares of Series B-2 preferred stock and acquired 384,000 warrants. As a result of this transaction, Unterberg obtained the right to acquire approximately twenty-one percent (21%) of our common stock. On May 13, 2014, we completed a 1:50 reverse split and on June 9, 2014 our common stock was up-listed for trading on Nasdaq.

In December 2015, we sold, through a registered shelf offering, a total of 2,731,651 shares of our common stock, at a purchase price of $2.18 per share (the closing bid price of our common stock on the last business day prior to the sale). In this offering, Unterberg acquired 1,834,862 additional shares of common stock. No warrants were issued as part of this transaction. In connection with the December 2015 transaction, Unterberg also provided us with written notice that it was waiving the 4.99% voting limitation provision (effective as of sixty one (61) days from the date of the notice) contained in the Series B-2 preferred and was irrevocably converting all of its Series B-2 preferred stock into shares of common stock effective such 61st day.

In January 2016, Diker and various other Diker funds disaffiliated with Unterberg. On February 11, 2016 and March 23, 2016, respectively, each of Unterberg and Diker converted all of their shares of Series B-2 preferred stock into shares of common stock. Following this conversion and giving effect to the disaffiliation that occurred in January 2016, Unterberg owned and/or had the right to acquire 4,029,499 shares of our common stock, or 27.24% of our total voting power.

Reasons for Stockholder Approval

Our common stock is listed on The Nasdaq Capital Markets and, as a result, we are subject to Nasdaq’s Listing Rules. Nasdaq Listing Rule 5635(b) requires that companies obtain stockholder approval prior to certain issuances with respect to their common stock or securities convertible into their common stock, which result in or could result in a deemed “change of control” of the issuer. This rule is referred to as the “Nasdaq Change of Control Rule.” Generally, Nasdaq interpretations provide that a “change of control” may be deemed to occur if, after a transaction, a single investor or an affiliated investor group acquires or has the right to acquire, as little as 20% of a listed company’s common stock (or securities convertible into or exercisable for common stock) or voting power of an issuer, and such ownership would be the largest ownership position of the issuer.

On May 9, 2016, we received a determination letter from Nasdaq informing us that we were in violation of Rule 5635(b) as, according to Nasdaq, the sale of the 1,834,862 additional shares of common stock to Unterberg in December 2015, together with Unterberg’s election to lift the 4.99% voting restriction and to convert all of its shares of Series B-2 preferred stock, resulted in Unterberg having the right to acquire and vote more the 20% of our voting securities and resulted in Unterberg becoming our single largest stockholder. In that determination letter, Nasdaq advised us that we had forty-five (45) calendar days to submit a plan to regain compliance with Rule 5635(b), and that if such a plan were timely submitted by us, the Nasdaq staff may grant us up to 180 calendar days from May 9, 2016 to regain compliance. On August 1, 2016, we were advised that our plan of compliance was approved. That plan included the execution of a standstill agreement by Unterberg and an undertaking by us to seek the stockholder approval contemplated by this Proposal.

If this Proposal is not approved by our stockholders at the Annual Meeting, then, under the terms of the standstill agreement with Unterberg, we will be obligated to exchange the shares of common stock owned by Unterberg that are in excess of 19.9% of our voting power into shares of a new, yet to be created, class of preferred stock that have restricted voting rights.

Board Recommendation and Vote Required for Approval THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" PROPOSAL 5. THE APPROVAL OF PROPOSAL 5 REQUIRES THE AFFIRMATIVE VOTE BY HOLDERS OF A MAJORITY OF VOTING SHARES CAST AT THE ANNUAL MEETING, IN PERSON OR BY PROXY, AND ENTITLED TO VOTE ON THE PROPOSAL. ABSTENTIONS AND “BROKER NON-VOTES” WILL HAVE NO EFFECT ON THE OUTCOME OF PROPOSAL 5.

PROPOSAL 6

NON-BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATION

In accordance with the requirements of Section 14A of the Exchange Act and the related rules of the SEC, our stockholders have the opportunity to cast an advisory vote to approve the compensation of our Named Executive Officers as disclosed pursuant to the SEC’s compensation disclosure rules, including the compensation tables and the narrative disclosures that accompany the compensation tables (a “say-on-pay proposal”).

The “Executive Compensation” section of this proxy statement describes in detail our executive compensation programs and the decisions made by the Compensation Committee with respect to compensation for the fiscal year ended December 31, 2015. As we describe in that section of the proxy statement, our executive compensation program incorporates a pay-for-performance philosophy that supports our business strategy and aligns the interests of our executives with our stockholders. The Board believes this link between compensation and the achievement of our near and long-term business goals has helped drive our performance over time. At the same time, we believe our program does not encourage excessive risk-taking by management.